The Ultimate Guide to College Financial Aid

By now you probably know the sticker price isn't always the final price.

The first step

No matter what, the first step is to file the FAFSA (Free Application for Federal Student Aid), available in December.

Filing your FAFSA also gives you the amount of federal aid you're eligible for depending on your family's financial information and household size.

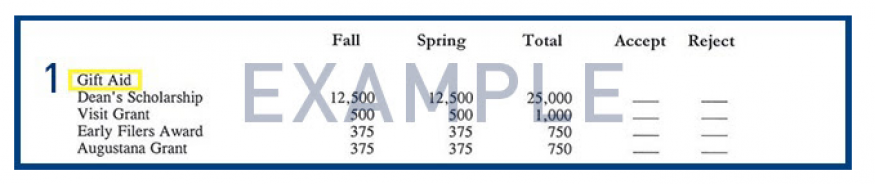

Reading an award letter

Here are some examples from Augustana's financial aid award letter.

Gift aid

These funds don't have to be repaid unless you fail to meet certain terms (like GPA requirements or specific deadlines).

Gift aid can be awarded based on financial need, academic excellence, talent-based auditions, early FAFSA filing, visiting campus, etc.

Work eligibility

You can get a campus job regardless of financial need, but some students with demonstrated need will see Federal Work Study on their award letter.

At Augustana we don't include work study when calculating your out-of-pocket expense since the amount is dependent on how many hours you work and whether you decide to put your wages toward your tuition bill.

Some other schools may include this in your out-of-pocket expense, so that's something to look for.

Loans/other

These are funds that must eventually be paid back to the lender by the student.

All FAFSA filers may borrow up to $5,500 in their first year through the Federal Direct Student Loan program.

Your family may also choose to apply for a Federal Parent PLUS loan or an alternative or private loan to help pay for your out-of-pocket costs.

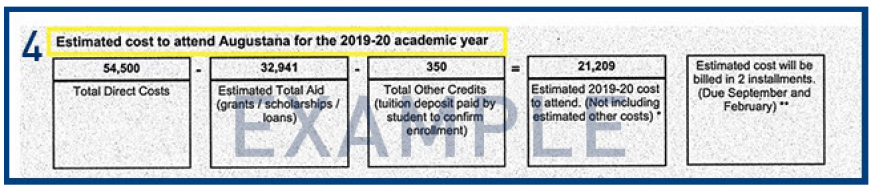

Determining your cost

Next, Augustana gives all students a comprehensive cost/payment worksheet so you and your family can have a better understanding of your total out-of-pocket costs.

It's based on your direct costs for Augustana and the financial aid you've been awarded.

Here's an example of the cost/payment worksheet:

Estimated cost to attend Augustana

At the top of your worksheet, you'll see the calculation of your cost to attend (total direct costs minus total financial aid).

Your cost to attend will be billed in two installments, due in September and February at the start of fall and spring semester.

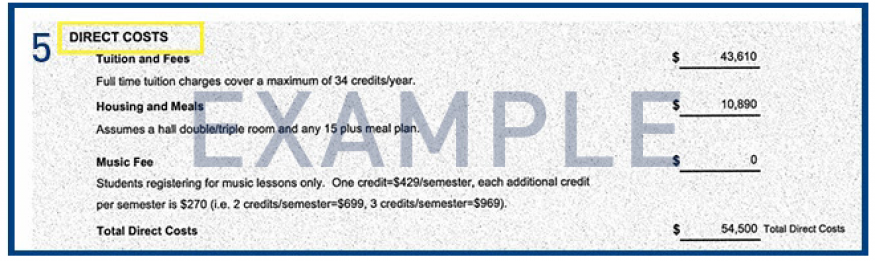

Direct costs

These costs are billed by Augustana, including tuition, fees, housing and meals and music fees (if you're registered for lessons).

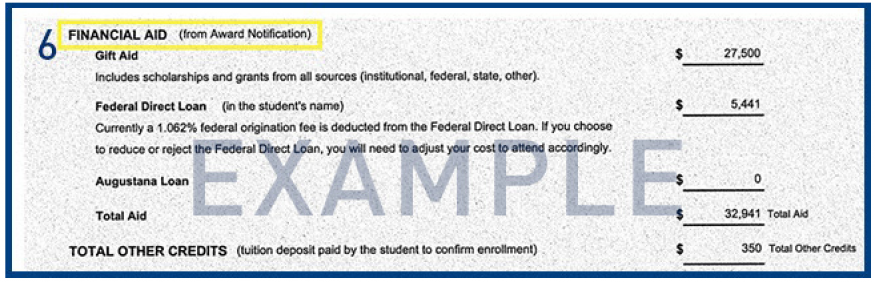

Financial aid

You'll see that the amounts for gift aid and student loans matches your award letter (we don't include work study or a Federal Parent PLUS loan).

Other institutions may calculate a Federal Parent PLUS loan into their cost of attendance, but it's not a guarantee. The parent will not be eligible for the loan until a credit check has been processed by the U.S. Department of Education.

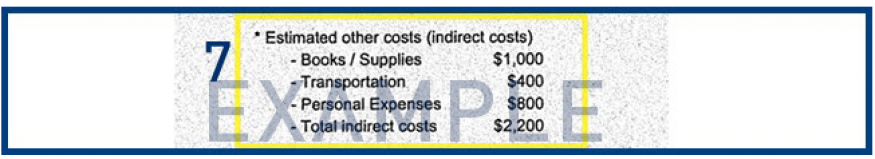

Indirect costs

It's important to budget for indirect costs, too.

When you choose a school, be sure to consider the cost of things like books, transportation to/from campus and miscellaneous personal expenses.

They can add up quickly and make a big difference in your budget.

Paying out of pocket

Finding a job

One way you can pay for indirect costs can be with money you make as a student employee.

Nearly half the students at Augustana work on campus!

Here's how on-campus jobs were at Augustana:

- You can apply for an on-campus job as long as you're enrolled at least half time (six credit hours)

- As with all employment, you'll need to complete required tax forms

- You can work up to 10 hours per week

- If you want additional hours or a flexible schedule, we offer the Flexible Employment Program (an on-campus temp agency)

- All job postings are on Handshake, our online recruiting platform

- You can start your job search by attending the campus job fair during Welcome Week

Typical jobs that are available for students include:

- Residence hall desk assistant

- Office or academic department assistant

- Dining services and catering

- Library assistant

- Facilities and grounds

- Athletic department

- Recreational Center intramural assistant

- Performance hall staff

- Bookstore or mailroom assistant

Are you still looking at your out-of-pocket costs and wondering how you can make it work?

Student Loans

Many students know they'll need to borrow money to afford college, but they're worried about being buried in debt after graduation (for good reason!).

We want to make sure you have the information you need to be a responsible borrower.

Some key facts about student loans:

Student loans are fund that must eventually be paid back to the lender, so it's important to only borrow what you need.

All students who file the FAFSA are eligible for a Federal Direct Student Loan.

You may borrow up to $5,500 in your first year, $6,500 in your second year and $7,500 in your third and fourth years.

In order to take out a direct loan, you must complete loan entrance counseling and sign a Master Promissory Note (MPN).

Parent PLUS loan

Federal Direct PLUS loans are low-interest loans available to parents. Eligible parents may borrow up to the cost of attendance, minus the total financial aid received.

If a parent is not approved for a PLUS loan, then a student may receive additional Unsubsidized Federal Direct loan.

To begin the process, a parent will complete a PLUS loan application and then sign a Master Promissory Note (MPN). The loan application can be found in the financial aid packet you receive in the mail or on our website.

Private loans

Private/alternative loans are credit-based loans offered by some banks and credit unions.

Private loans usually require the applicant to have a co-signer and have varying interest rates, fees and repayment options.

You should only consider private loans after all your federal loans, grants and scholarships have been used, and the PLUS loan for parents has been considered.

Payment plans

Augustana also has a payment plan option!

Typically these payment plans start in July and last over the 10-month period of the school year.

If you and your family don't want to borrow your entire out-of-pocket cost, our payment plan can be part of your solution.

Scholarships

There are probably a lot of scholarships out there that you're qualified for but just don't know about.

Take a minute to register at Fastweb, a nation-wide scholarship search site, and check it regularly.

Make sure you search within your community. Organizations and foundations from your hometown may offer opportunities you aren't aware of yet.

When I went to college, I found a scholarship through an organization just for residing within my county. Every bit helps.

I know we've discussed a lot about how to read your award letter and how to calculate your out-of-pocket expenses with the cost/payment worksheet, but you probably still have some questions.

Choosing a college may be the biggest decision you've made so far, and it's important to get answers to your biggest questions so you can be confident in your decision to become a Viking!

Our financial aid staff is one of the best you'll find, and we're here to answer any questions you might have.

You can always give us a call or send and email, whether you're on campus or still at home. We're here to help current and future vikings.

Ready to get started?

Schedule your financial aid phone call.